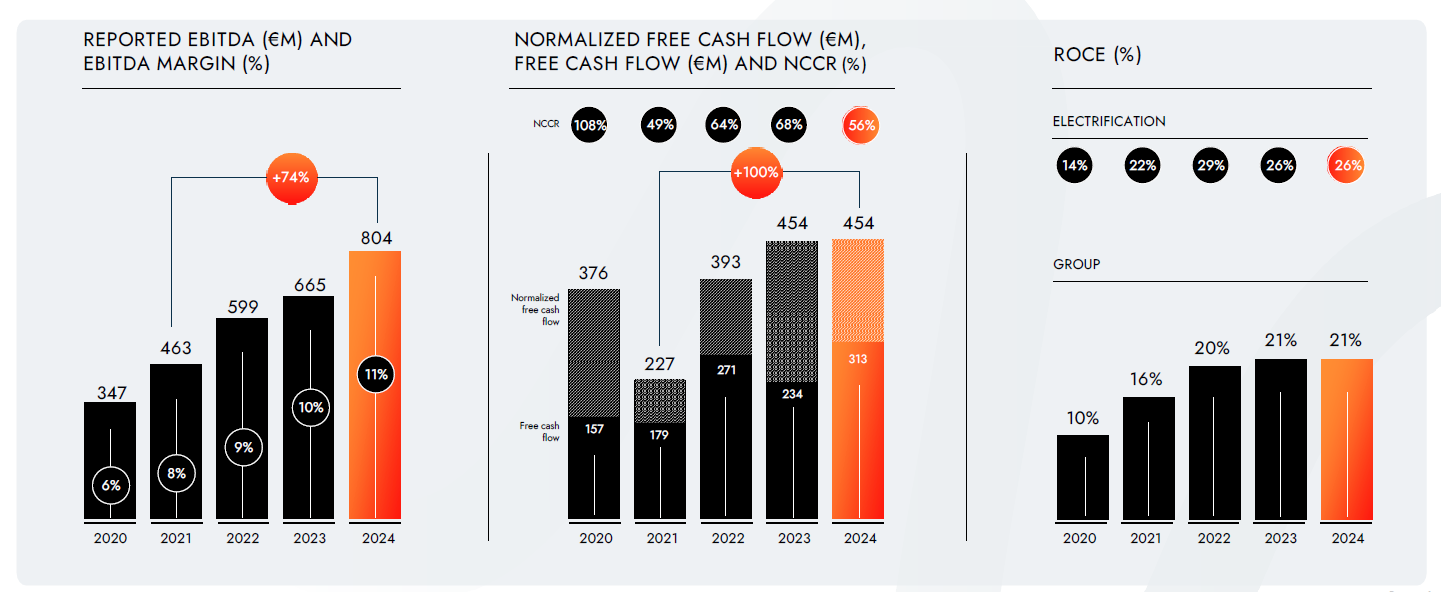

On its existing Electrification portfolio, Nexans will continue to drive selective and profitable expansion, expecting an organic growth of 3-5% CAGR. An incremental adjusted EBITDA of +€350 million is targeted between 2024 and 2028 in Electrification businesses.

Nexans is also unveiling its 2028 financial targets at the Group level:

- Adjusted EBITDA at €1,150 million (/- €75 million) while completing its portfolio rotation towards Electrification.

- Return on Capital Employed above 20% thanks to profitability expansion, strict working capital management, and disciplined investment.

- Capital Expenditures around €1.2 billion between 2025 and 2028 to fuel growth, with a reallocation towards PWR-Grid and PWR-Connect segments (formerly Distribution and Usage) during the period, boosted by growth capex.

- Cumulative free cash flow before M&A and equity operations is expected to land around €1.4 billion between 2025 and 2028, with a solid conversion rate ratio above 45% in 2028.