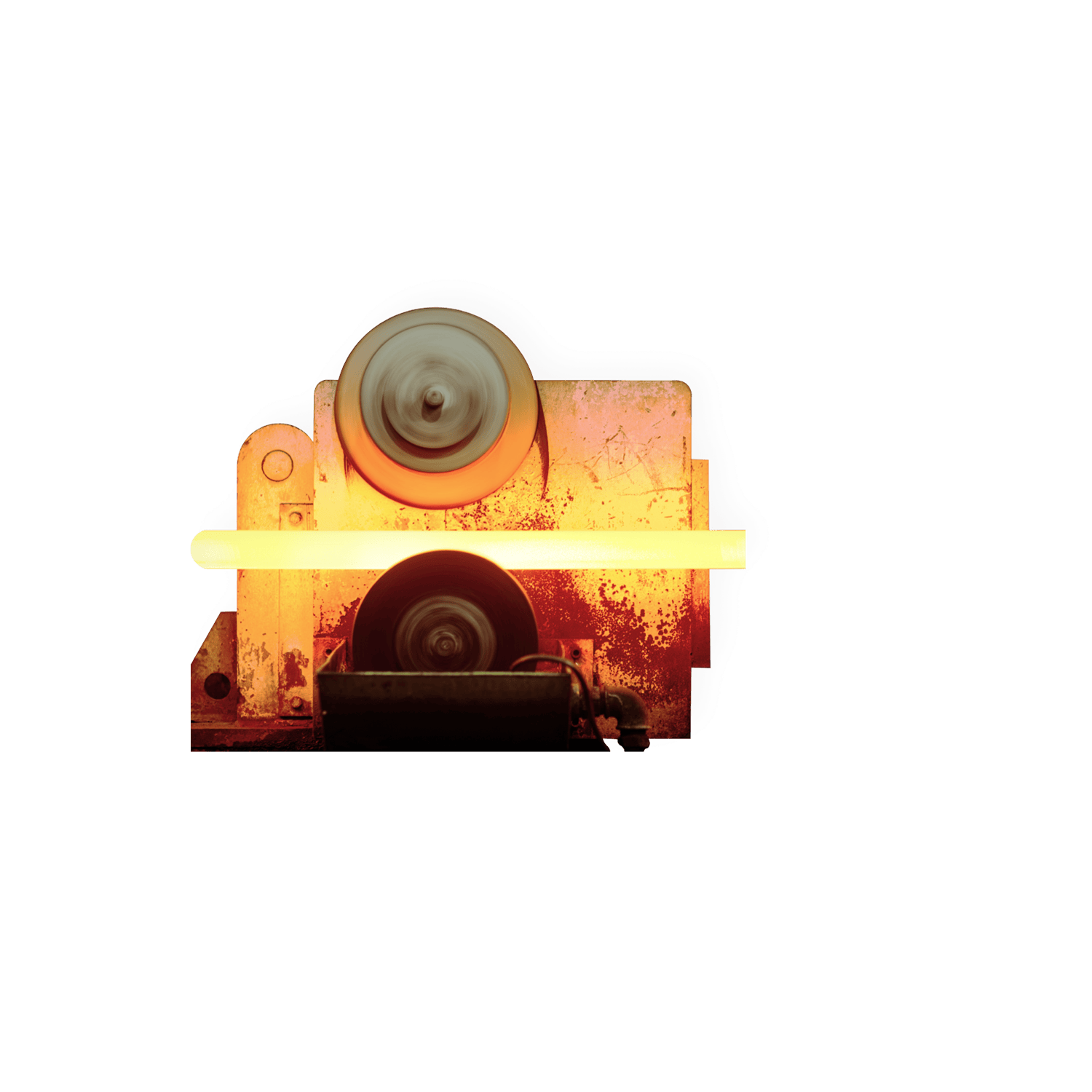

Integrating the metallurgy activity

Nexans is the world’s leading vertically integrated manufacturer of cables, with 4 metallurgy plants: Lens (France), Montreal (Canada), Lima (Peru), Santiago (Chile).

Spotlight on Superconductivity

Innovations in Accessories and Solutions

Digital disruptions transforming the electrification industry

Innovations for Electrical Transmission

Innovations for Electrical Grids

Innovations for Buildings' Revolution

10 Technologies to Electrify the Future

Access all series

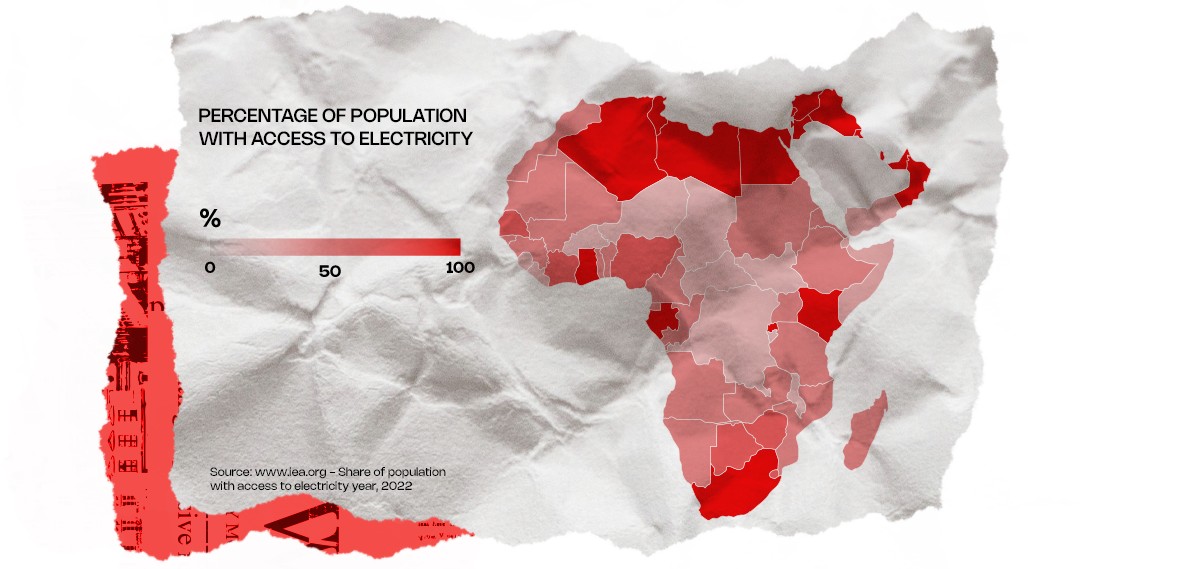

Africa is caught in a paradox: it emits only a tiny proportion of greenhouse gas (GHG) emissions but suffers disproportionately from the consequences. And while demand for electricity is currently low, it is set to grow exponentially across the continent.

At the same time, global GHG emissions totaled 57.4 gigatons (CO2 equivalent) in 2022. According to the United Nations Environment Program, this is an increase of 62% over1990.

The need to develop sustainable electrification in Africa is therefore clear. Some countries, such as Morocco, Niger and Benin, have already committed to ambitious targets, particularly in renewable energies, but the process will require a collective effort on a scale never seen to date.

The African continent is experiencing strong demographic growth. This trend is set to continue, alongside improvements in average living standards and faster development of industry, trade and agriculture. All these factors will drive higher demand for electricity over the next few years.

According to the International Energy Agency (IEA), electricity consumption in Africa currently totals around 730 TWh, barely more than a country such as Germany. This underlines the paradox of the African continent. Despite making only a tiny contribution to greenhouse gas emissions, it is more vulnerable than any other region to the effects of global warming (droughts, floods, impact on water and agriculture, etc.). More than any other region, Africa needs to satisfy the huge demand for electricity in order to unlock its economic potential and improve living conditions in some regions. This will involve deploying agricultural greenhouses and desalination plants such as the facility in Casablanca, Morocco.

Africa is heavily dependent on fossil fuels, which currently make up 80% of its electricity mix. This type of fuel is cheaper and historically more accessible than clean energies. To achieve sustainable electrification, it will be necessary to gradually phase out the old polluting power plants with renewable alternatives.

Demand for electricity was expected to bounce back by 3% in 2023 (after a slight decrease), rising by 4.5% in 2024 and 2025. However, a more substantial increase in demand is expected over the long term. One of the IEA scenarios forecasts a rise to 2,400 TWh across the continent by 2040!

Factors such as population growth, urbanization, industrial expansion and global warming are automatically translating into higher electricity demand. According to IEA figures, global consumption already totaled 24,398 TWh in 2022, a threefold increase on 8,132 TWh in 1981. And this figure is unlikely to fall any time soon! The World Energy Council expects consumption to exceed 40,000 TWh per year in 2040, a leap of over 40%.

The facts set out by the International Renewable Energy Agency (IRENA) are nevertheless clear: to limit global warming to 1.5°C, we have no choice but to cut annual emissions of carbon dioxide (CO2) by around 37 gigatons compared to 2022 ! In addition, the energy sector must achieve net zero emissions by 2050.

The solution lies in making the transition from fossil fuels to decarbonized electricity. However, we will need to deploy 1,000 GW of renewable energies (solar, wind or hydropower) every year to meet this target. Yet new facilities supplied only an additional 300 GW in 2022, which is not sufficient to keep pace with growing demand.

In IRENA’s ideal scenario, the figure would be 29% in 2030 and 51% in 2050.

Africa is the least electrified continent. To fully understand the situation, we need to remember that some 43% of the African population still has no access to electricity in the home. Although figures vary from country to country, and from region to region within the same country, this figure still represents over 600 million people across the continent. This situation naturally has an impact on the population (in terms of health, education and economic development, for example). According to the World Bank, new connections are no longer keeping pace with population growth, owing primarily to an increase in prices of raw materials.

Other obstacles include outdated energy production facilities and a lack of transmission and distribution infrastructure. Economic development and digital inclusion are severely impacted by the frequent failures of the existing system and the instability of the network. According to IRENA, 41 % of companies are experiencing supply problems, causing an estimated 2% fall in Africa’s GDP.

Through rural electrification (via standalone systems and mini-grids), it will be possible to develop remote regions and stop not only the rural exodus, but also rural desertification, these being the direct consequences of inappropriate agricultural practices, deforestation, and so on. Note that 80% of the people without electricity live in these regions.

In order to supply power at the right price while supporting economic development, it will be necessary to focus on innovation and the training of qualified personnel. We need to de-risk investment, reinforce and modernize equipment and network infrastructure, facilitate installation and maintenance, develop eco-design and recycling, introduce new payment models, and so on.

As part of this, it is essential to secure supplies in sectors such as transport, industry and construction. How? By installing high-power cables. Superconducting cables, for example, can transport large quantities of energy whenever and wherever required, usually in large cities and conurbations.

One fact is certain: the circular economy is a key component of sustainable development, and one that could also help to bring down the price of electricity. However, making the circular economy a reality will require substantial investment (plant construction, vehicle acquisition, training, etc.) and the emergence of local industries, particularly recycling. For this reason, it is important for all players – public, private and international – to join forces and to develop these sectors through strategic partnerships.

Achieving sustainable electrification will involve not only developing renewable sources and resilient networks, but also optimizing usage through energy-efficient buildings and equipment. This will mean setting energy performance targets and implementing measures to achieve them (insulating walls and roofs, integrating smart management systems, monitoring energy usage, etc.). For Africa, these improvements are essential. The energy savings obtained will reduce the price per kWh while limiting the growing demand for electricity (by 230 TWh in 2030 according to the IEA, or 30% of current consumption levels).

To meet these challenges, Africa has a huge asset: a renewable energy potential that is far greater than anywhere else in the world. According to a report by Deloitte, this potential amounted to 10 TW of solar capacity, 110 GW of wind and 35 GW of hydro in 2023. However, it is still largely under-exploited. Only 2.7 GW of renewables were added to the total in Africa in 2023, for a global total of 473 GW. By way of comparison, China has deployed no less than 297.6 GW, or almost 63% of the total. In late 2023, Africa’s installed capacity stood at 13.47 GW for solar power, 8.6 GW for wind and 37.82 GW for renewable hydro, making up only a tiny proportion of the global base, estimated at 1,419 GW for solar power, for example.

IEA forecasts for the African energy market expect the situation to change rapidly, with most new energy sources being renewable by 2025. Sustainable electricity generation is expected to follow a similar trend, increasing by more than 60 TWh. It would then account for almost 30% of total electricity generation, compared with 21% in 2021.

Several countries are already engaged in this dynamic and are implementing proactive policies, leading the way for the rest of the continent. With nearly 4.6 GW of installed renewable capacity, Morocco has announced the deployment of a further 7.5 GW as part of its 2023-2027 electricity equipment plan. The proportion of renewables in the electricity mix is set to rise to 52% by 2030.

Another example is Niger, which has set an ambitious electrification target for 2018 with the signing of the Document de politique nationale d’électricité (document on national electricity policy) and the Stratégie nationale de l’accès à l’électricité (national strategy for electricity access). Eighty percent of the population should have access to electricity by 2035!

Achieving these objectives will require a particularly high levels of investment. A number of solutions exist to facilitate this process:

Among the existing initiatives, we should mention Nexans Morocco, which is supplying turnkey cable systems for photovoltaic panels. This reduces the total cost of ownership of solar power plants and cuts the time required for installation, thereby limiting the investment required.

To meet both financing and innovation needs, it will also be necessary to set up strategic collaborations between government bodies, businesses and associations.

Let’s take the example of an ambitious project such as Mission 300. Supported by the World Bank and the African Development Bank, its purpose is to provide access to electricity for 300 million people in sub-Saharan Africa by 2030. For the moment, however, total contributions stand at 30 billion dollars, far short of the 90 billion required.

Sustainability has long been part of the strategy implemented by Nexans, with excellent results. Between 2019 and 2023, for example, Nexans was able to cut its greenhouse gas emissions by 36%. To achieve this, the Group implements a “local-for-local” approach with the aim of serving most customers within a radius of 1,000 km, for a smaller carbon footprint and lower transport costs.

In Africa, where Nexans has been present since 1947, this strategy is supported by Nexans Morocco. The company has already forged several partnerships and launched collaborative projects, and is playing a key role in the electrification of Africa.

This is one of the Group’s few business units supplying not only cables, but also transformers and turnkey projects

VP Innovation, Nexans

In particular, Nexans Morocco has set up metal crushing and separation facilities with local companies. Through this initiative, it is able to recycle 83% of production waste. It has also launched several initiatives including the Nexans Climate Challenge. This event recognizes and rewards the projects that are most promising from a socio-environmental standpoint, allowing the ecosystem to work with start-ups. The winners of the 2023 edition included MAG Power, a project for mobile power stations using lithium batteries charged by renewable energies and fully recyclable.

The Nexans Foundation is also involved in a number of collaborative projects in Africa, such as training young people in electrical trades through the organizations IECD and ACCESMAD, installing solar panels in health centers in Côte d’Ivoire, and connecting hospitals to the grid in the DRC.

Sustainable electrification is undeniably a key pillar of the energy transition in Africa. It simultaneously addresses the three crucial challenges of energy access, energy efficiency and cost control. Faced with a steadily growing demand for electricity, Africa needs to address the challenge of supplying clean, affordable energy that is accessible to everybody.

Collaborative projects are playing a decisive role, supported by innovative financing and strategic partnerships. Public, private and international players can join forces to make sustainable electrification a reality in Africa, enabling the continent to meet its energy needs, and also to position itself on the front line of the fight against climate change, the impact of which is felt more acutely here than anywhere else in the world.

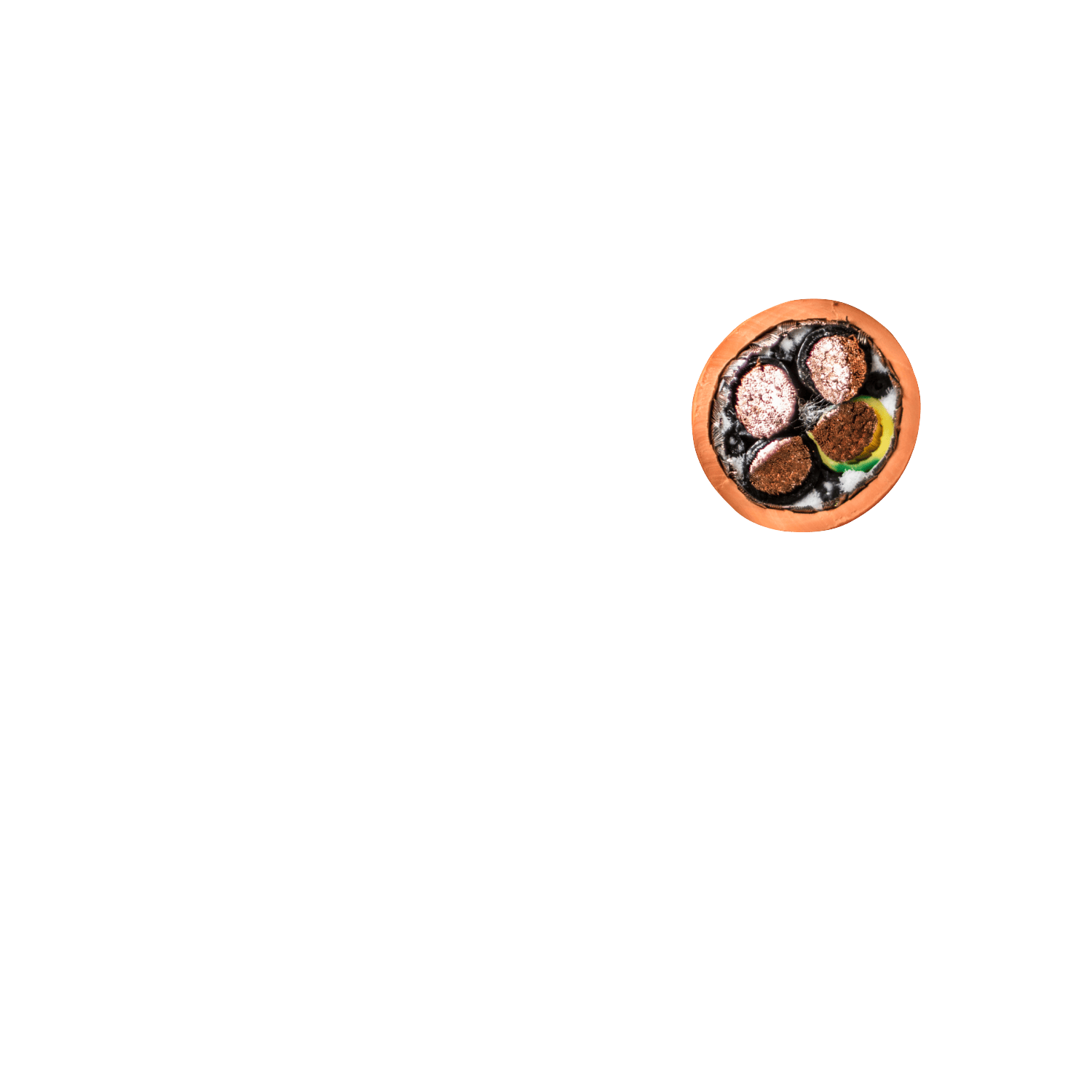

Copper, the first metal worked by man at the dawn of the Neolithic revolution and at the heart of the second industrial energy revolution at the beginning of the 20th century, is today one of the pillars of the ongoing energy transition.

Between increasing shortage of resources and rising global consumption.

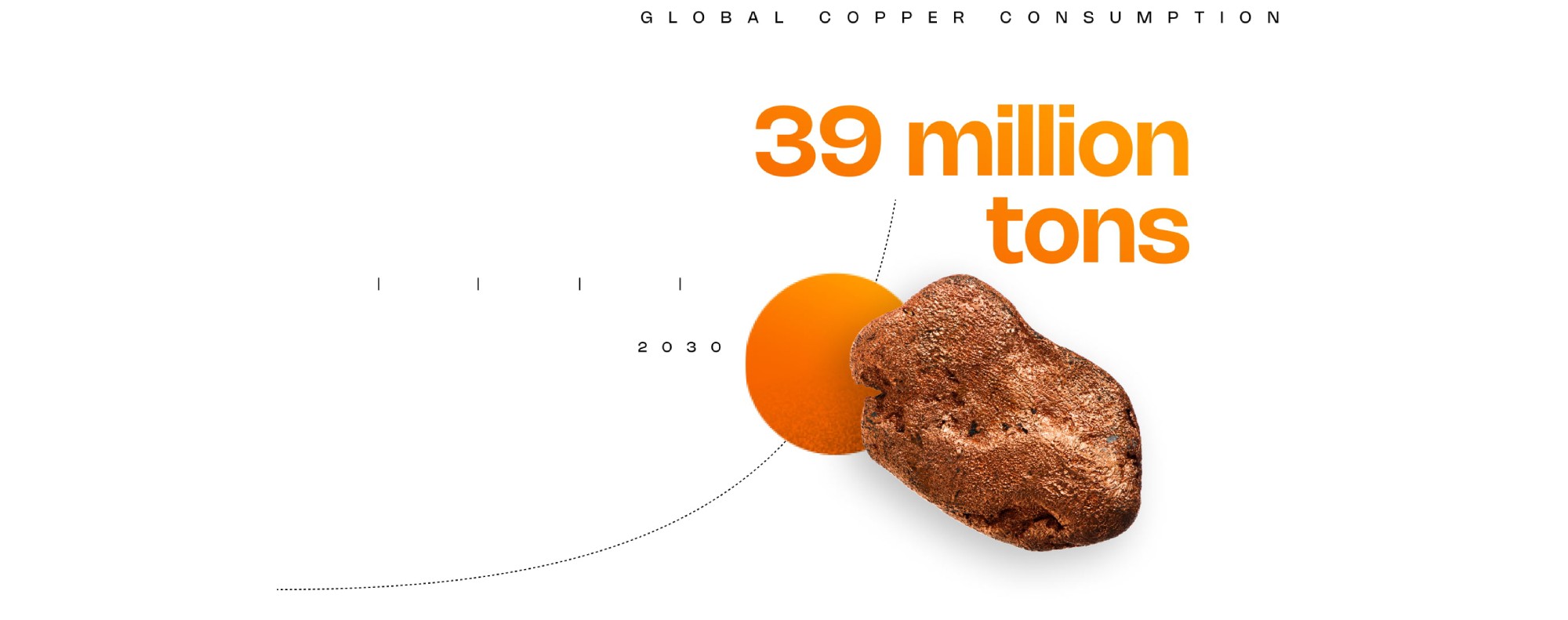

The electrical cable industry, which has already undergone many transformations in its long history, is facing a new challenge. At the same time, it is facing an explosion in demand for electricity, and therefore an expected increase in global copper consumption.

Weight in million tons (Mt)

Sources: Goldman Sachs / ICSG / Nexans Analysis

Annual production of

24Mt of copper and 10Mt of scrap for the next 5 years…

… for a 39Mt annual

copper demand in 2030

Sources: Goldman Sachs / ICSG / Nexans Analysis

40 to 80%

copper

Sources: Nexans

Nexans is the world’s leading vertically integrated manufacturer of cables, with 4 metallurgy plants: Lens (France), Montreal (Canada), Lima (Peru), Santiago (Chile).

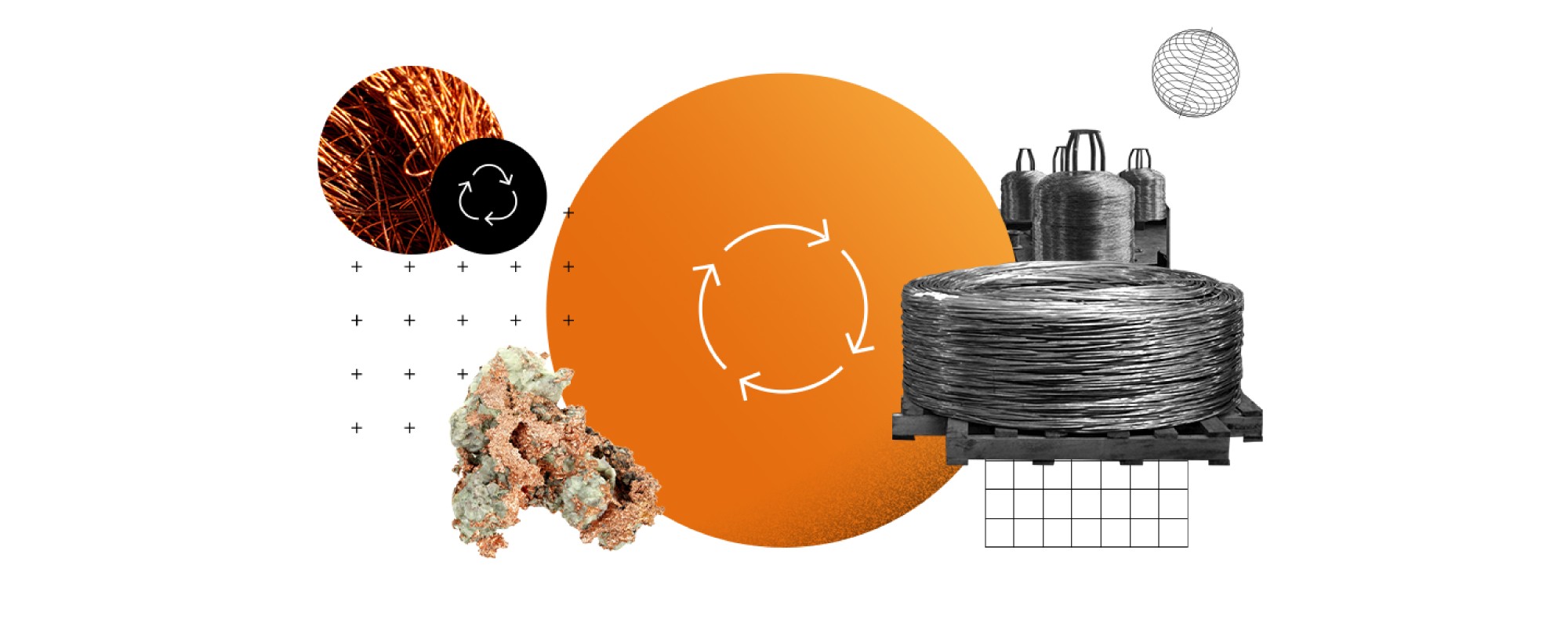

All copper waste undergoes a recycling process.

Improving copper collection from the electrical networks of our cities and infrastructures.

For information

Nexans has been working with RecyCâbles (a joint venture between Nexans and Suez) since 2008. In 2023, 9,410 tons of cable waste have been processed within this facility.

I believe in inventing a new business management model, in which the circular economy will be replaced by circular performance. In other words, an ethical and circular model, but not one that is diminishing.

Christopher Guérin

CEO, Nexans

A shift is under way. Many countries, including the USA and France, are turning away from the factory-free economy – the dominant model of the past last 30 years – to rediscover the advantages of manufacturing at home. This shift creates a unique opportunity to promote the development of new-generation plants, reflecting new economic, social and environmental challenges. Local for local has always been the watchword at Nexans, which is seizing this opportunity to take a new step forward in its development. By integrating its rigorous management model with its international production base, the company will be in industry 4.0 mode by 2026.

When we talk about the digital revolution, we tend to think first of the glut of the information inundating our lives, every day of every week, announcing a new revolutionary smartphone, a new multi-cooker or the latest mind-boggling breakthroughs in artificial intelligence (AI). It’s a subject that has only recently come to the fore in the business world, with the fierce debate around the impact of AI on business activities and the rapid automation expected in many areas, from programming to accounting, medicine and law.

Paradoxically, industry has attracted far less interest as a subject of discussion. And yet it is a subject of key importance, not only in terms of jobs, innovation and value creation, but also in terms of sovereignty. The Covid-19 pandemic was a wake-up call for European countries, which became aware of the scale of their economic and strategic dependence, in the light of the tensions between China and the United States. Factories have a key role to play in adapting our economies to the new technological order.

This comes as no surprise, since changes in the workshops have always been associated with breakthroughs in technology, continuing a cycle that began with two industrial revolutions. The steam engine and the first factories were followed by the arrival of electricity, machine tools and mass production, and then – in the 1950s – by electronics, automation through programming, numerical control machinery, industrial robots and the first supervisory software packages.

The fourth revolution, currently unfolding, directly continues the ongoing process of computerization, while taking it to a whole new level. The first step is to establish a new energy base, moving away from the fossil fuels that powered the previous three revolutions. The second step is to maximize the use of a key new resource – corporate data – by building on a powerful high-tech mix that has now reached maturity: very high-speed infrastructure (fiber for fixed connections and 5G for mobile), combined with data hosting and mass processing (Cloud, Big Data, AI), decentralized intelligence and smart objects (IoT) and new forms of human-machine interaction (mixed reality, digital twinning, avatars).

This avalanche of innovations is paving the way for a complete rethink of the way companies work, with particular emphasis on all the processes involved in production. For many industrial powers, this is now a priority. It is no coincidence that Germany was the first to launch an Industry 4.0 plan in 2011, with an eye to maintaining the excellence of its industrial base. Pursuing the same objective, China is investing in high value-added factories in order to retain its industrial might and address a growing labor shortage. France adopted a similar strategy in 2015, with its Alliance for the Industry of the Future, an association of 32,000 companies meeting every year at the Global Industry trade show. This year, Nexans was in the spotlight claiming two Golden Tech awards in the Designer and Maker categories at the 2023 event, held last March in Lyon.

These goals are part of a new commitment involving everybody at Nexans. The Group is moving towards the global digital integration of all areas of the company and its ecosystem in order to simplify processes, improve performance and response, boost productivity and safety, limit unnecessary operations, as well as to anticipate and plan for events (predictive maintenance, inventory management, customer satisfaction, etc.).

In a recent survey of French business, 98% of the companies interviewed said that they have already planned or deployed initiatives relating to Industry 4.0 (7th edition of the Wavestone barometer on Industry 4.0, conducted in partnership with Bpifrance and France Industrie).

The main motivations cited are industrial performance (for 30% of respondents) and data control (27%). Note that ecological impact and energy performance were in third place this year (15%).

The Nexans Group took the first step towards change in late 2020, when it teamed up with Schneider Electric, a company with proven experience in transforming its own industrial base. The process initiated by Schneider Electric places the emphasis on reliability, productivity, improved availability through predictive maintenance, energy efficiency and protection against cyber-attacks. The first step in the partnership involved major investments at pilot sites in Autun, France and Grimsås, Sweden. The process will be deployed at eight more sites by the end of 2023, with the aim of upgrading all 45 Group plants on four continents by late 2025, at a pace of between 12 and 15 sites every year.

Nexans plants upgraded

by the end of 2023

Nexans plants upgraded

by late 2025

Nexans plants upgraded

pe year

These fundamental changes involve the mobilization of Group data: the raw material of this new industrial revolution. Although the proportion of data used by the Group rose from 5% to 10% between 2019 and 2023, the aim is to reach 70% by 2026.

We are approaching the Group’s digital transformation on two levels, first by integrating new technologies into our operations, and second by creating a collaborative environment.

Chief operating officer, Nexans

This approach connects production tools using IoT and AI resources, while allowing employees to take back control through dashboards, decision-support indicators, and quality and safety monitoring. It also supports efforts to cut response time and time to market.

First, we will see changes in the way we work every day. Because the transformation is not just about technology, even though connected machines, AI-powered robots are becoming an increasingly common site in factories, along with self-driving forklift trucks roving the aisles of the logistics centers by day and by night. However, the most spectacular changes concern human workers, with workshops packed full of screens, tablets and connected goggles.

This is a sensitive subject, since the success of the transformation will depend on how well people are able to work alongside machines. This is precisely the aim of Industry 5.0, as it is sometimes called. The objective is to expand and strengthen the digital transformation by supporting better collaboration between people and machines, while ensuring that creativity and well-being are not overlooked.

This aspect is taken into account from the outset in the Nexans project:

Discover with Chao Li, Digital Development Engineer, and Tobias Karlsson, Predictive Maintenance Operator in Grimsås how predictive maintenance has been put in place in our Swedish factory. The objective is to monitor the main production indicators such as temperature, pressure, traction, to detect evolution on the trends of these parameters.

We can now pick up on many errors before they occur. It’s a bit like being able to see into the future with all the data collected.

Predictive maintenance operator at Nexans in Grimsås, Sweden

This digital transformation program supports our operators and make their life easier facilitating access to all needed documents and supporting remote production.

Discover with Chao Li, Digital Development Engineer, and Mylène Iller, Production Operator in Autun (France), how operators’ lives is made easier.

When we get back from vacation, for example, all we have to do is look at the news feed to find out what’s been happening while we’ve been away, on our line and on the site in general.

Production operator at Nexans in Autun, France

Lionel Fomperie, Nexans Group Industrial Strategy Director and Thomas Wagner, Nexans IS Performance Director give a general program overview and explain how Operations are working together with IT/OT to generate IT/OT and Cybersecurity platforms.

At this key stage in the process, the aim is for digitization to free operators from repetitive work, so that they can focus on tasks with higher added value. The digital transformation will also play a role in increasing the appeal of our business for the younger, digital-native generation, while creating opportunities for us to enrich job profiles, reduce the time spent on machines, and enhance skills through appropriate training programs.

To harness its full power, this new approach to managing the production base must be integrated with the company’s strategic objectives. Taking this process as far as possible, Nexans is making sure that its industry 4.0 plan is consistent with the E3 management model, underpinning the transformation of the group by supporting the goals of economic performance, environmental virtue and employee commitment.

Lionel Fomperie, Group Industrial Strategy Director, Chao Li, Digital Development Engineer and Olivier Ameline, Nexans Excellence Way Director drive us through three use cases: Unified Operation Cockpit (UOC), MES Performance (Manufacturing Execution System) and SQDCE Digital board: S for Safety, Q for Quality, D for Delay, C for Cost & E for Environment.

Copper, the first metal worked by man at the dawn of the Neolithic revolution and at the heart of the second industrial energy revolution at the beginning of the 20th century, is today one of the pillars of the ongoing energy transition. Boosted by the widespread use of electric vehicles, the proliferation of wind farm projects, the modernisation of electricity grids, the renovation of buildings and investment in the factories of the future, copper is everywhere. But with resources becoming increasingly scarce, geopolitical tensions and the need to protect the planet, the electrical cable industry is having to reinvent itself around new sustainable business models. Nexans is at the forefront of this transformation thanks to its history, its early investment in the field and its strategic vision of a model combining responsibility and performance.

The electrical cable industry, which has already undergone many transformations in its long history, is facing a new challenge. The proliferation of electrification projects required by the energy transition is leading to an explosion in demand for electricity, and therefore an expected increase in global copper consumption, which is expected to reach 39 million tonnes in 2030 (compared with 13 million in 1995 and 29 million in 2020). At the same time, we must cope with the predicted scarcity of mining resources, limited by an annual production of 24 million tonnes over the next 5 years.

The price of copper doubled during the Covid-19 pandemic providing a foretaste of the pressure that awaits cable producers. This equation depends on access to an increasingly disputed resource, and on a price adjustment that weighs heavily on their business models, given that copper can account for up to 70% of the cost of cables.

Although the reuse of copper scrap is a long-standing practice in the industry – Nexans has been doing it for nearly 40 years – it has become imperative for the entire industry to get involved. However, the 9 million tonnes of copper currently produced from recycling will not be enough to make up for the production shortfall and satisfy the increase in demand.

A difficult transition lies ahead, after almost a century of an economy driven by waste and disposability. We have now entered the age of recycling, the age of the circular economy. This shift implies a complete rethink of all the company’s activities, from upstream to downstream, from design to distribution, including the key production stages.

We are in fact at the start of a movement that is set to accelerate, because even though less than a third of manufacturers have begun transforming their value chains beyond the core plants, more than 80% of French companies have already worked on circular business models (INEC survey, “Pivoter vers une industrie circulaire”, Dunod, 2022).

I believe in inventing a new business management model, in which the circular economy will be replaced by circular performance. In other words, an ethical and circular model, but not one that is diminishing.

« POUR ALLER DANS LE BON SENS », LE CHERCHE MIDI, 2023

Recycling and better control of supplies are no longer enough to define a strategy that meets the challenges. Switching from a linear economy to a circular economy implies a profound change in all the company’s business lines, so that the change of model becomes virtuous.

A good example of the holistic approach needed to implement a profitable circular strategy is the new range of low-carbon distribution network cables that Nexans has just launched in France. By considering each stage of the value chain and the entire life cycle of a cable, it is possible to reduce greenhouse gas emissions from low and medium voltage cables by 35% to 50%, depending on the product. For example, in addition to using copper, this means using low-carbon aluminium and recycled plastics and guaranteeing the use of renewable or low-carbon energies in cable production.

Christophe Allain, Nexans’ Global Portfolio Director Non-Ferrous Metals, points out that to achieve such a result, all business lines must be involved: “This unique offer illustrates our teams’ commitment to sustainable development, from our worldwide Ampacity R&D centre in Lyon to our product plants, including our marketing and purchasing teams and, of course, our partner suppliers.”

This is an essential offering at a time when Nexans’ customers are themselves pivoting towards a sustainable economy. Such is the case with Schneider, which is a pioneer in this area by putting circularity and, more broadly, the environment at the heart of a strategy rolled out through a number of programmes: eco-design, use of higher-quality materials, more modular, connected and repairable products, the emergence of “Energy as a Service” models, decarbonisation of value chains, waste-free production plants and leasing offers.

Finally, over and above the economic benefits and the renewed confidence of key customers, the move towards a circular economy is also an asset for the re-engagement of the company’s teams. Because the more the change is real and based on concrete objectives and measured results, the more the teams will find their commitment meaningful and motivating.

Nexans, the world’s leading manufacturer of vertically integrated cables, has an advantage that gives it direct access to copper cathodes in mines. For the Group, this means controlling its supplies while maintaining the lead it gained many years ago through the integration of its own metallurgy business: the only remaining copper smelter in France – Lens- two in South America – Chile and Peru- and a mega-smelter in Montreal.

This strategy alone is not enough today. We need to supplement these sources of supply by significantly stepping up our recycling efforts. “For our electrical cable production activity, we use up to 6% and 14% recycled copper, depending on our production sites in Lens and Montreal”, says Franck Ruelle, Recycling Services Manager at Nexans, and Philippe Demarez, Director of the Lens site, “and this proportion will only increase in the future.”

Nexans is committed to using urban mines to transform our industry and enter the circular economy. It is essential to improve copper and aluminium recovery from electrical networks in the real “urban mines” that are our cities and our infrastructures, where the level of collection can be improved. To achieve this, the Group has been working since 2008 with RecyCâbles, a joint venture between Nexans and SUEZ. Over the course of 2022, 14,000 tonnes of used cables were processed at the Group’s plants. In the future, this collaboration could be extended to other recycling players to develop a circular chain specific to the cable industry. For example, telco operator Orange’s historic lines will technically be phased out in 2030. It will therefore be essential to ensure the recovery of this entire copper network, so that it can be recycled and reused. There are other potential initiatives with scrap merchants and waste collection centres, which are essential parts of the jigsaw and therefore at the heart of the circular economy.

In this way, controlling the end-to-end value chain also makes it possible to leverage several parameters which, in addition to lead times and cost prices, can become genuine guarantees of quality and environmental commitments to which Nexans’ customers and partners are now very sensitive.

This also involves the long-term management of supply contracts, such as the one just signed for five years with the Polish group KGHM for the supply of copper cathodes, which now also factors in a lower level of carbon emissions by using rail transport between Poland and France. This approach goes hand-in-hand with joint membership of the Copper Mark to promote responsible copper production worldwide. As a result of this policy, the Lens and Montreal sites were awarded this same label for responsible copper production in August 2023.

But the fact remains that for our entire economy to switch to this new model, pioneers must lead the way by demonstrating the benefits for the planet as well as the advantages for new sustainable growth. If copper is often cited as an example of a well-managed circular economy, then the energy cable industry is at the forefront of a “Green deal” that the European Union has begun to roll out since 2019, with ambitious targets for 2030 on the way to carbon neutrality for EU countries by 2050.

Plastic is not good for the environment: everyone knows it and everyone makes efforts to avoid it, or at least to sort it better. However, it is still essential in many sectors. Indeed, it remains very important in the design of cables because of its exceptional properties: mechanical, dielectrical, processability, durability…

The problem lies in the poorly managed and uncontrolled plastic waste streams that endanger ecosystems around the world:

To face the growing volume of plastic produced, used and dumped, industries have to evolve to a fully circular model in which end-of-life plastic products are not discarded but transformed to create value. Innovation, regulation and international collaboration are needed to enable this transition.

In addition to resource management and pollution issues, plastic materials have an impact on greenhouse gases. A kg of polyethylene produced in Europe for plastic manufacturing has a carbon footprint of roughly 1.8 kg of CO2 equivalent.

Industrial-scale plastics production began in earnest in the 1940s and rapidly increased in the 1950s. More than 8 billion tons of plastics have been produced worldwide since 1950, making it a widely used manufactured material (Geyer et al., 2017).

Plastics offer various benefits such as a high strength-to-weight ratio, and the ability to tailor their physical properties to be hard or soft as needed. This versatility and durability, combined with the low cost of plastic production, is the major reason why plastics are currently used in almost every sector.

Today, almost all plastic is derived from materials made from fossil energy (primarily oil and gas). This causes several problems:

According to OECD, “Plastic pollution is growing relentlessly as waste management and recycling fall short”. Indeed, it is estimated that only 9% of plastic waste is recycled, and 22% is mismanaged. Due to the durability and strength of the material, plastic waste remains in the environment and takes decades or even centuries to decompose naturally. It involves the loss of biodiversity and alteration of ecosystems (MacLeod et al., 2021).

Hopefully, a transition of plastic materials is possible:

The major challenge of industrial activity is to drastically limit the impact on the environment. There are three main issues that are interconnected:

Environmental challenges are at the center of Nexans cable solutions development. We commit to reduce the environmental footprint of our cables thanks to the selection of materials. More than ever, Nexans aims to invent innovative materials that combine eco-design, performance, durability and recyclability.

The incorporation of recycled materials in new products is a challenge for all industries. Nexans has launched a company-wide initiative to use up to 30-60 % recycled plastics in different cable families across the electrification chain.

Nexans works to improve the recycling of end-of-life cables and offers to collect customers’ wastes through Nexans Recycling Services. Moreover, Nexans has an objective to recycle 100% of its production wastes by 2030, with a circular economy dynamic. Plastic wastes sorting and valorization are now at the center of several R&D projects to answer all the blocking points (e.g. legacy additives, plastic mix separation, crosslinked polymers recycling…).

The current valorization efforts of existing end-of-life cables highlight substantive problems linked to their complex designs or to their various components. New products are now created with a strong will of eco-design including:

Innovation will be key to the transition from a linear to a circular model for plastics materials. It requires the development of specific technologies, but will also have to include supply chain and business model components that will be only possible through ecosystems.

Jean-François Larché is Team Leader Advanced Materials working for Innovation, Services and Growth in Ampacity, Nexans’ innovation hub in Lyon. He is working on material development transversally for the Group with a focus on product sustainability (recycled content, recyclability…). He joined Nexans in 2011 working for 8 years mainly on cable durability.