- Nexans announces having entered into exclusive negotiations with Latour Capital for the sale of Lynxeo for €525 million, subject to customary approvals

- With the proposed transaction, Nexans would achieve major step on its strategy to become a Pure Electrification Player

Nexans announces today having entered into exclusive negotiations for the sale of its industrial cable division Lynxeo to Latour Capital, a France-based private equity fund, for an Enterprise Value of €525 million. This proposed transaction would mark Nexans’ exit from the specialty industrial cables activity in line with its strategy to refocus as a Pure Electrification Player.

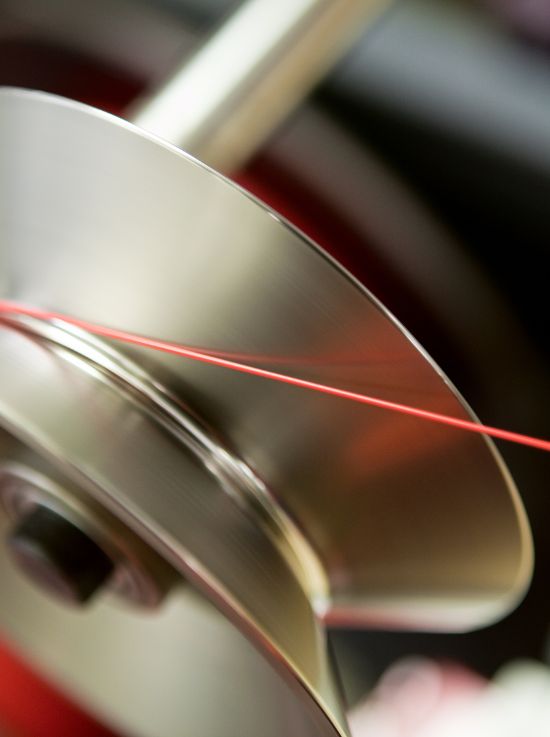

Lynxeo is a powerhouse in specialty industrial cables and plays a key role as a fully integrated player, serving a diversified range of infrastructures industries in transportation, energy and automation. With a heritage of more than 100 years serving industrial champions, Lynxeo boasts a global manufacturing presence in Europe, Asia, and the United States of America, with 2,000 employees and annual standard sales of over €700 million.

This agreement marks a pivotal milestone in our electrification journey. It will streamline our operations and ensure efficient resource allocation. Our long-term vision for sustainable growth and leadership in the electrification ecosystem starts now. Under Latour Capital’s expert guidance, Lynxeo’s future will shine brightly. Their wealth of experience and strategic insight will undoubtedly catalyze Lynxeo’s growth and innovation.

Chief Executive Officer, Nexans

Lynxeo is a unique opportunity in the specialty industrial cables, ideally positioned in a highly fragmented and growing market. We firmly believe in Lynxeo’s strong growth potential and are pleased to embark on this exciting journey.

Senior Partner and Partner, Latour Capital

The relevant works council will be informed and consulted in connection with the proposed transaction. In addition, the proposed transaction remains subject to the fulfilment of customary regulatory approvals. On this basis, the closing of the proposed transaction could take place in the second half of 2025.

J.P. Morgan Securities Plc is acting as exclusive financial advisor to Nexans while Bredin Prat is acting as legal counsel on the transaction.