- 2023 standard sales of €6.5 billion, €7.8 billion current sales, strong profitability expansion and excellent cash generation.

- Nexans delivered on all its objectives, which were upgraded last July, confirming the depth of its transformation year after year:

-

- Adj. EBITDA at a historic high of €665 million, up +8% year-on-year, and adj. EBITDA margin at 10.2%; EBITDA including share-based payments at €652 million, outperforming target

- Focus on value added solutions (SHIFT Prime) generating +€20 million incremental EBITDA in its Electrification businesses

- Outstanding Normalized FCF at €454 million, reflecting strict management of working capital and Generation & Transmission’s adjusted backlog growth

- Strong balance sheet maintained with net debt at €214 million and a 0.4x leverage ratio.

- Proposed dividend up +10% to €2.30 per share.

- Electrification Pure Player profile strengthened by M&A and investments:

-

- Acquisition of Reka Cables in Finland with integration progressing ahead of plan, finalization of the divestment of Telecom Systems activity

- MoU signed to expand medium voltage capacities in Morocco and serve the booming demand for the grid in the region

- Halden high-voltage plant capacity extension completed early 2024 and new cable-laying vessel construction on track to deliver record Generation & Transmission adjusted backlog of €6.1 billion

- Continued progress in CSR performance: -36% decrease in Scope 1, 2 and 3 GHG emissions ahead of SBTi targets.

- Full-year 2024 guidance announced:

- Adj. EBITDA of between €670 and 730 million

- Normalized Free Cash Flow of between €200 and 300 million

- Capital Markets Day to be held on November 13th, 2024.

Full press release

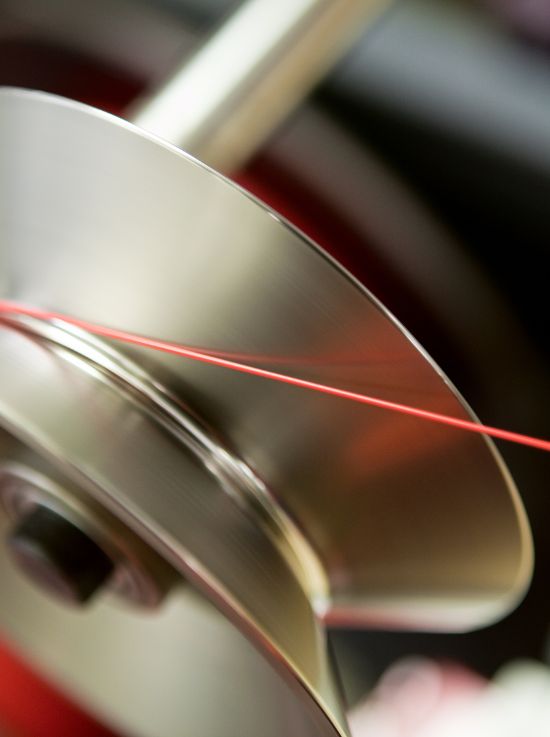

Nexans, a global leader in the design and manufacturing of cable systems to power the world, announces its financial results for the fiscal year 2023. The results were approved by the Board of Directors on February 14, 2024.

Download the report (PDF – 1MO)Nexans’ robust performance in 2023 once again demonstrated the scale of our disciplined transformation since 2019. We delivered a record adj. EBITDA margin, and exceeded normalized free cash flow generation expectations. I would like to thank all our employees, who are the driving force behind our journey.

We made considerable progress on our sustainability agenda with GHG emissions at –36% versus 2019 (Scopes 1, 2 and 3), extending the deployment of our E3 performance model across our units.

On the acquisition front, we finalized a high-quality acquisition, with Reka Cables in Finland, and exited the Telecom Systems business, strengthening the Group’s profile, now resolutely focused on sustainable Electrification. The recent announcement of the signed agreement to acquire La Triveneta Cavi in Italy, with recognized excellence within the European low-voltage segment, is an additional milestone in our journey to become a global Electrification Pure Player.

Despite the ongoing macroeconomic uncertainties, we are entering 2024 with confidence and expect another year shaped by strong performance.

CEO, Nexans